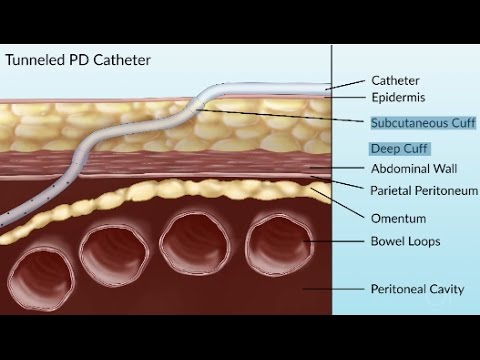

Music you complications of peritoneal dialysis by Dr. Sharon Sue. Introduction: Hello, my name is Dr. Sharon Suva, a pediatric nephrologist. Today, I'm going to talk to you about peritoneal dialysis dialysis catheters. One question that often comes up is, when can you use a dialysis catheter? This depends on the situation of the patient. If it is acute peritoneal dialysis, the reason you put in the catheter is because you need to start dialysis immediately. However, if it's chronic, such as planned for a patient that is reaching end-stage renal disease or currently has a vascular catheter for hemodialysis but will be transitioning to peritoneal dialysis, then you have a little bit more time to use the catheter. For chronic peritoneal dialysis, it is very important to start with very slow or small fill volumes. That way, you will reduce the chance of leakage. Ideally, if you do have time to wait, you would want the site to heal well and seal off from leakage. So, if you put in a catheter and you can wait because you have other forms of renal replacement therapy, such as hemodialysis, then I would recommend waiting two to four weeks before starting peritoneal dialysis. Another thing to consider is that there are different types of catheters. In general, for chronic peritoneal dialysis, catheters that are cuffed, as well as swan-neck, which means they curl off at the end to reduce the risk of touching other organs and causing blockage, are used. These theoretically reduce the risk of infection and are used for patients who will be on chronic peritoneal dialysis. Cuffed catheters are also tunneled through different layers of the skin from the epidermis to the sub-q layers and then into the abdominal cavity. So, they are made so that the risk of infection...

Award-winning PDF software

Cms guidelines for peritoneal dialysis Form: What You Should Know

Is my property in a like-kind exchange? If you want to avoid reporting a capital gain, your property must have an adjusted basis of at least 50,000 if it's a capital property. When is my income eligible for the like-kind exchange deduction? Generally, all gross income that you have received or will receive after your tax year ends is taxable. However, certain income or expenses of your business that are capital (meaning they are used to producing income) or trade or business property (meaning they have a basis on which the cost of producing or selling them would be deducted) qualify for the like-kind or Section 1031 exchange deduction. See IRS Publication 590, How to Complete 1031 Exchange. Can I add my rental properties to another owner-occupied rental property? To enter a rental property into a like-kind exchange after the second owner-occupied rental property was sold but the first owner-occupied rental property is still listed, follow the steps below. For more information, see IRS Publication 502, Miscellaneous Deductions & Credits, and IRS Publication 587, Business Expenses and Other Sources of Income. The owner-occupied property in the like-kind exchange needs to be one of the following: Owned and occupied for use as both rental property and for gain or profit as a business, such as if it is rented at a profit to multiple owners. Owned and occupied as a single-family residence. The owner-occupied property is treated as a single-family residence if: The owner-occupied property has not been for rent for 30 out of the 60 months before the first rental year you exchange homes. One of the other owner-occupied properties listed previously is no longer owned, and you have already made a like-kind exchange within 30 months of the second rental year you exchange homes. Have you made a like-kind exchange? See IRS Publication 502, Miscellaneous Deductions & Credits. You should have income in the current tax year from the year you received the property in the like-kind exchange, from the prior years in which you received an equivalent property in a like-kind exchange, and from taxes, interest, rents, or depreciation on the property for the two-year period before you exchange properties.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form CMS-3427, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form CMS-3427 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form CMS-3427 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form CMS-3427 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Cms guidelines for peritoneal dialysis